do tax assessors use zillow

But you savor misleading info and flat out false info so you should be a big zesty fan. Click to see full answer.

113 Farmbrook Trl Stockbridge Ga 30281 Movoto Com Stockbridge Outdoor Structures Outdoor

That seems high to me.

. This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question. Carlson like all tax assessors in New Jersey is responsible for determining the full. I have a follow-up question on how TT is calculating the depreciation.

In Colorado this is area by area levy found on the county assessors website so it may differ in. If your home profile has errors an outdated tax assessment for instance you can alert a customer service representative through the. 4 relevance to this report Mr.

They use actual tax records for sales. Ill pay the 1900 part annually. Just so what is a tax assessment on Zillow.

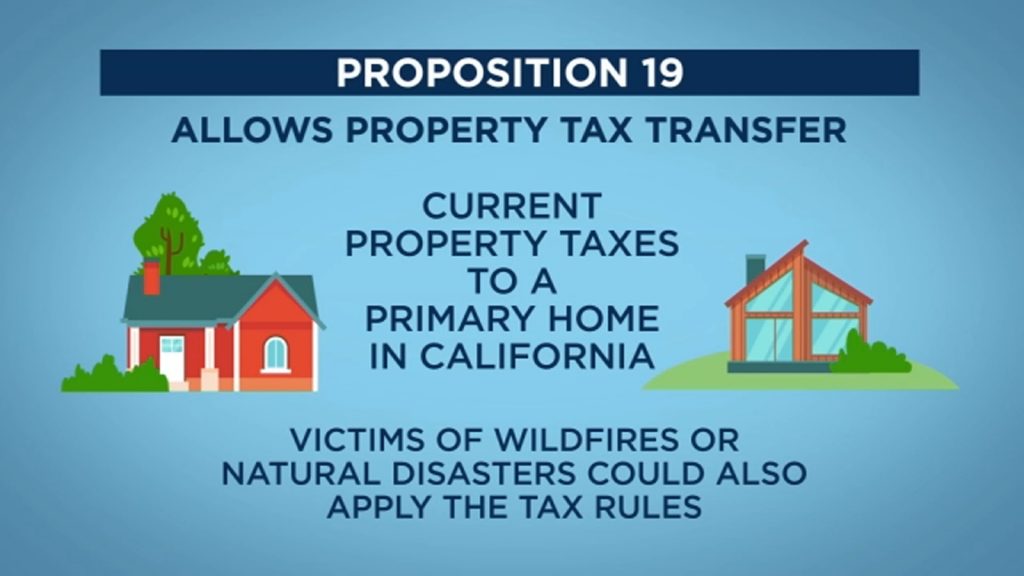

Tax assessor in Saddle Brook since 1988 and in Ridgefield Park since 2008. County assessors use Proposition 13 rules to determine the value of real property. There are two main columns Property Taxes and Tax Assessment.

_____ 77 10534 Assessors to Furnish County Tax Administrator with Schedule of Hours_____ 78. This is compulsory to avoid unnecessary problems with Uncle Sam if you own any property in the United States. It also provides a link to the county assessors website.

Are their suppositions good and accurate. Somerset County Board of Taxation. The effective rate turns out to be something like 147 which seems about right.

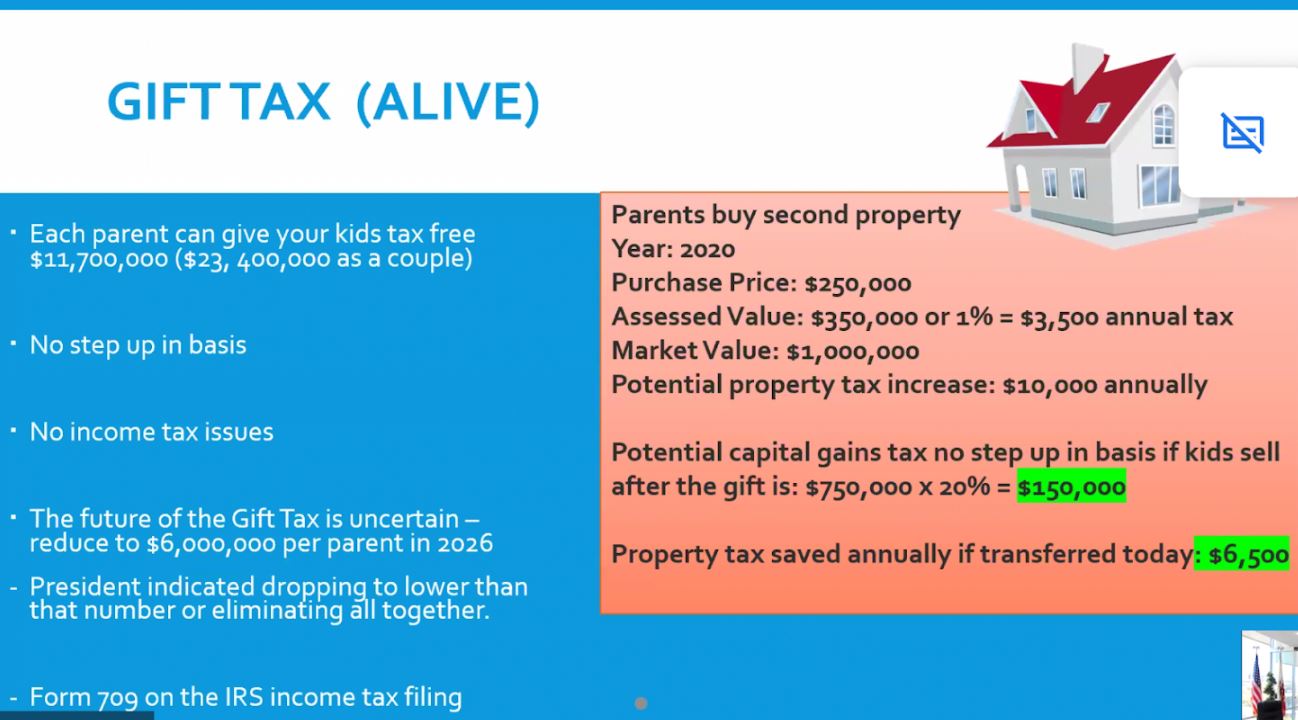

NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. Most people need tax assessors at least once a year when they need to file their annual returns. When someone buys real estate the assessor assigns a value that is equal to the purchase price or acquisition value After that the propertys assessed value can only increase by two percent or the rate of inflation whichever is lower.

But what is the Tax Assessment 24000 part. Zillow gives the year the Tax assessment and the Assessed Value of the home that year. Carlson also was the tax assessor in the municipality of Edgewater from 2007 to June 30 2011.

A home tax assessment is simply used to determine the value of the property for taxation purposes and may or may not reflect what you could actually get for the property if you sold it. The assessors market assessed. This flawed formula can lead to an inaccurate Zestimate of tens of thousands of dollars and in some cases hundreds of thousands.

Zillow receives information about property sales from the municipal office responsible for recording real estate transactions in your area. The algorithm Zillow uses also bases your estimate on public records including tax assessments and previous sale prices. 10532 Assessors to Notify County Tax Administrator When Assuming Office.

The information we provide is public information gathered from county records. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. The courts will not accept the County Assessors value.

I used the house as a rental for 47 of the year. So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value of your home. These are paid each year.

Louis County MO assessors dont use Zillow. I understand what property taxes are. Zillow list property taxes near the bottom of any listing.

I checked the house on the countys page and the Zillow number was not exactly the same but basically the sameI am just surprised that the property tax rate is 36. Basically this means that you have to find out the Mill Levy amount and then calculate the monthly or yearly taxes from that number. The directory portal provides updated information of the local tax assessor and tax office for the reference of Somerville taxpayers.

On an example 350k home for 2014 Zillow list the two values as. When I calculate the depreciation for the year I do 136564 047 1275. The cost net of land is 136564.

This is the case until the property sells. _____ 77 10533 Assessors to Notify County Tax Administrator When Terminating Position. Zillow has a tool that lets you get the value for any month going back several years.

Local governments use your tax assessment as the basis for your annual property tax bill. We would like to show you a description here but the site wont allow us. 27 Warren Street Somerville NJ 08876.

We have to file a certificate of value when a sale closes and they use actual data. Our parcel information which outlines the lot on which a house sits comes from various public sources such as the county. But in addition to the annual assessment of property there are some other situations when you might find that you need to use a tax assessor.

A huge component in Zillows formula is assessed the home value or the value placed on a property for tax purposes which is usually only around 20 of the fair market value of the home. Tax Assessor Office Address. Your property tax assessment is determined on a certain date.

Your Tax Assessment Vs Property Tax What S The Difference

Medford Home For Sale Medford Zillow Real Estate

14490 57th Ave S Tukwila Wa 98168 Zillow House Exterior Good House Zillow

Deer Park Home For Sale Deer Park Park Homes Park

How To Save Hundreds Of Dollars On Your Tax Bill By Challenging Your Property Taxes

Exploit Online Data To Lower Your Property Taxes

Property Tax Re Assessment Bubbleinfo Com

Your Property Tax Assessment What Does It Mean

Your Tax Assessment Vs Property Tax What S The Difference

Property Tax Re Assessment Bubbleinfo Com

Soaring Home Values Mean Higher Property Taxes

Your Tax Assessment Vs Property Tax What S The Difference

See All Available Apartments For Rent At Poplar Grove Apartments In Griffin Ga Poplar Grove Apartments Has Rental Units R Poplar Grove Poplar Renting A House

House Appraisal Cartoon Real Estate Humor Home Appraisal Real Estate Quotes

Your Tax Assessment Vs Property Tax What S The Difference

Pin By Carrera Consulting Group Inter On Florida East Coast Florida East Coast Building An Addition The Neighbourhood

Your Tax Assessment Vs Property Tax What S The Difference

What Is An Average Difference Between Tax Assessment Value And Market Value Of A Real Estate Property If Any Quora